39 yield to maturity of coupon bond

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

› calculator › bond_yield_calculatorBond Yield Calculator - Moneychimp Coupon Rate: % Years to Maturity: ... Bond Yield Formulas See How Finance Works for the formulas for bond yield to maturity and current yield.

Yield to maturity of coupon bond

Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). goodcalculators.com › bond-yield-to-maturityYield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ... 1 Find the yield to maturity on a semiannual coupon bond given that the ... See Page 1. 1. Find the yield to maturity on a semiannual coupon bond given that the bond price is $988 having at the coupon rate of 8%. The bond has a face value of$1000, and there are 25 years remaining until maturity. A)7.22% B)8.11% C)8.81% D)9.41%. 2.Find the price of a semiannual coupon bond given that the coupon rate 5%, the face value ...

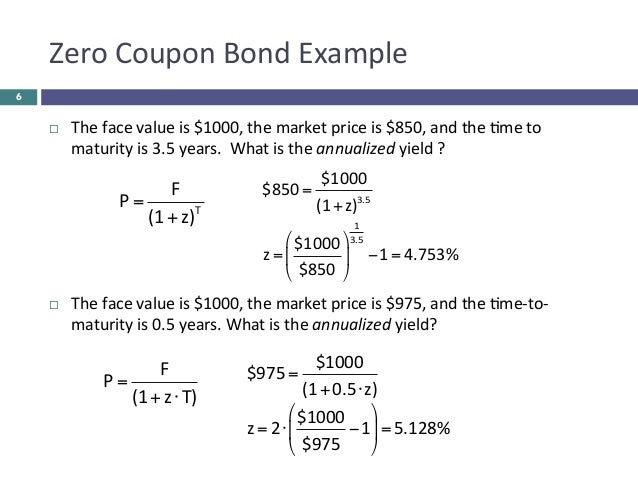

Yield to maturity of coupon bond. en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds HW 2.docx - .Question 1: (a) Calculate the yield to maturity of a three ... Unformatted text preview: .Question 1: (a) Calculate the yield to maturity of a three year bond with a face value of $1000, an annual coupon rate of 5%, and which is selling at a 2% premium?PMT = $1000 * .05 = $50. PV = $1000 * 102% = $1020 =RATE (3, 50, -1020, 1000) = 4.28% (b) Explain (one to three short sentences) why the yield to maturity is higher or lower or equal to the coupon rate. Yield to Maturity (YTM) - Definition, Formula, Calculations Use the below-given data for calculation of yield to maturity. Coupon on the bond will be $1,000 * 7.5% / 2 which is $37.50, since this pays semi-annually. Yield to Maturity (Approx) = ( 37.50 + (1000 - 1101.79) / (20 * 2) )/ ( (1000 + 1101.79) / 2) YTM will be - This is an approximate yield on maturity, which shall be 3.33%, which is semiannual. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Yield to Maturity (YTM) - Meaning, Formula & Calculation The price of the bond, the coupon payments and maturity value are known to an investor. However, the discount rate has to be computed. This discount rate is the yield to maturity. ... The Yield to Maturity (YTM) of the bond is 24.781%. After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like ... Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. 1 It is the sum of all of its remaining coupon payments.... Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Yield-to-Maturity (YTM) Formula. The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond's cash flows equal to the current market price. › calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be paid in biannual or quarterly installments. Fixed Rate Bonds – A fixed rate bond has a coupon that represents a fixed percentage of its par value.

Difference Between Coupon Rate and Yield of Maturity Coupon Rate. Yield of Maturity. 1. The amount paid by the issuer to the bondholder until it's maturity is called coupon rate. The yield of maturity means the total return earned by the investor until it's maturity. 2. The rate of interest is paid annually at a coupon rate. › terms › yYield to Maturity (YTM) Definition - Investopedia Nov 11, 2021 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield to Maturity (YTM): Formula and Excel Calculator From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the same interest rate. In This Article What are the steps to calculating the yield to maturity (YTM) in Excel? How to Calculate the Price of Coupon Bond? - WallStreetMojo Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as,

The price of a coupon bond and the yield to maturity | Chegg.com Question: The price of a coupon bond and the yield to maturity are. is, as the yield to maturity. the price of the bond a. negatively; rises; falls b. positively; rises; falls c. positively; rises; rises d. negatively; falls; falls related; that. This question hasn't been solved yet

› Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Learn the variations of yield to maturity. Bond issuers may not choose to allow a bond to grow until maturity. These actions decrease the yield on a bond. They may call a bond, which means redeeming it before it matures. Or, they may put it, which means that the issuer repurchases the bond before its maturity date.

Coupon vs Yield | Top 8 Useful Differences (with Infographics) 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below:

The yield to maturity on a bond is a below the coupon The bond's yield to maturity is below 9%. e. If the bond's yield to maturity declines, the bond price will be lower than its par value. b. If there is no change in it s yield to maturity over the next year , then the bond 's capital gains is positive . 50. A 12-year bond has an annual coupon of 9%. The bond has a yield to maturity of 7%.

Coupon vs Yield | Top 5 Differences (with Infographics) Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, and ...

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

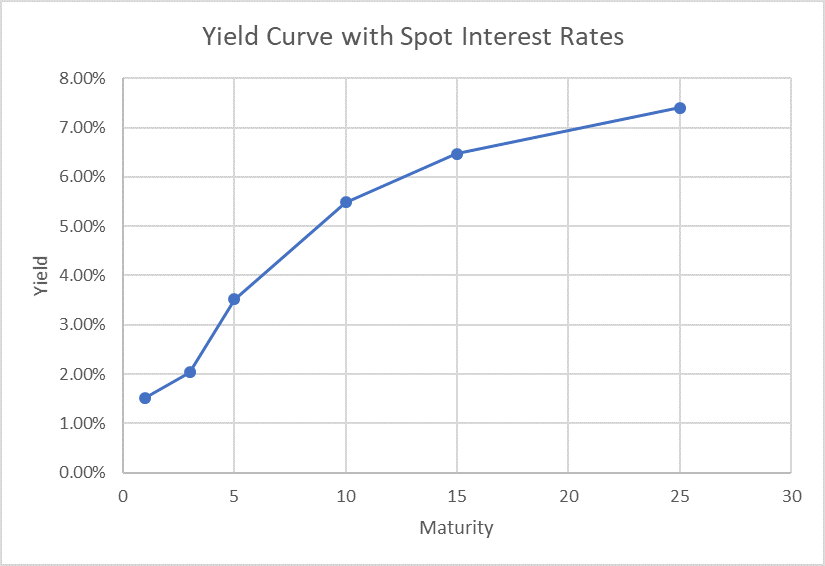

Understanding Bond Yields and the Yield Curve #Bonds #YieldCurve # ... Understanding Bond Yields and the Yield Curve When it comes to investing in bonds, one of the first factors to consider is yield. But what exactly is "y

Solved A 30-year maturity, 8% coupon bond paying coupons | Chegg.com A 30-year maturity, 8% coupon bond paying coupons semiannually is callable in five years at a call price of $1,100. The bond currently sells at a yield to maturity of 6% (3% per half-year). a. What is the yield to call annually? (Do not round intermediate calculations. Round your answer to 3 decimal places.) Yield to call % b. What is the yield ...

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Answered: 8 A bond with 10 years until maturity,… | bartleby 8 A bond with 10 years until maturity, an 8% coupon, and an 8% yield to maturity increased in price to $1,107.83 yesterday. What apparently happened to interest rates (6 %

1 Find the yield to maturity on a semiannual coupon bond given that the ... See Page 1. 1. Find the yield to maturity on a semiannual coupon bond given that the bond price is $988 having at the coupon rate of 8%. The bond has a face value of$1000, and there are 25 years remaining until maturity. A)7.22% B)8.11% C)8.81% D)9.41%. 2.Find the price of a semiannual coupon bond given that the coupon rate 5%, the face value ...

goodcalculators.com › bond-yield-to-maturityYield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

/165642901-56a0b1833df78cafdaa409a4.jpg)

Post a Comment for "39 yield to maturity of coupon bond"