38 what are coupon rates

Difference Between Coupon Rate and Interest Rate A coupon rate is an annual interest payment, which is provided by the bond issuer to the bondholder at the time of maturity. In the meantime, coming to the interest rate, it is the charges put on the payment by the lender to the borrower. Coupon Rate vs Interest Rate Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

Difference Between Coupon Rate and Discount Rate What is Coupon Rate? Coupon rates are generally affected by the loan fees set by the government.1 Subsequently, on the off chance that the public authority expands the base financing cost to 6%, any previous securities with coupon rates beneath 6% lose esteem. The coupon rate is communicated as a level of its standard capital.

What are coupon rates

Coupon Rate Calculator | Bond Coupon What is a coupon? A coupon is the interest payment of a bond. Typically, it is distributed annually or semi-annually depending on the bond. We usually calculate it as the product of the coupon rate and the face value of the bond. How often do I receive coupons from investing in bonds? The short answer is it depends on the bonds that you invest in. Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

What are coupon rates. Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. Car Rental Coupons for Discount Rental Cars | Avis Car Rental Save 10% on already LOW RATES at your neighborhood locations K348200 Up to 25% off base rates with 5% donated to Susan G. Komen® A349300 Up to 25% off base rates with 5% donated to Make A Wish® H749900 AARP members save up to 30% off base rates A359807 Up to 25% off base rates for veteran and military family T765700 What is coupon rate | Definition and Meaning | Capital.com A coupon rate is a yield that is paid out for a fixed-income security such as a government and corporate bond. A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. Coupon Rate Formula | Step by Step Calculation (with Examples) The term " coupon rate " refers to the rate of interest paid to the bondholders by the bond issuers. In other words, it is the stated rate of interest paid on fixed income securities, primarily applicable to bonds.

What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. What Is Coupon Rate and How Do You Calculate It? The coupon rate, or coupon payment, is the yield the bond paid on its concern date. This yield modifications as the worth of the bond modifications, thus giving the bond's yield to maturity. The same phenomenon can also be proven for an rate of interest of 4 p.c. What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean? What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase "coupon rate" for two reasons. Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and … Coupon rate - definition and meaning - Market Business News The coupon rate is the interest rate that the issuer of a bond pays, which normally happens twice a year. The bondholder receives the interest payments during the lifetime of the bond. In other words, from its issue date until it reaches maturity. Bonds are types of debts or IOUs that companies, municipalities, or governments sell and people buy. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon rates of such floating-rate securities come with a floor and a cap, which means the rate cannot decrease below the floor and cannot increase above the cap. Following our above example, suppose the bond comes with a floor of 5% and a cap of 10%. Therefore, if the 5-Year Treasury Yield becomes 4%, still the coupon rate will remain 5% ...

Coupon Rate - Wall Street Prep Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

What is a Coupon Rate? | Bond Investing | Investment U Coupon rates are the static variable in a dynamic bond market. This makes them an important variable in establishing market rates. The Inverse Relationship Between Price and Yield As bond prices fluctuate and coupon rates stay the same, the yield of a bond changes. This is an extremely important consideration because it changes the value of a bond.

Coupon Statistics - 2022 Update | Balancing Everything Any of the income groups note high coupon redemption rates and lots of users. Below, let's see what percentage of consumers from a certain earning level looks for deals and coupons. Over $200,000 - 86%; $100,000-149,000 - 85%; $20,000-39,000 - 87% (Hawk Incentives) 20. Coupon clipping companies help consumers save millions of dollars ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon Rate | Investor.gov Coupon Rate. The interest rate on a bond. It is expressed as a semi-annual rate. Featured Content. Investing Quiz - September 2022. Test your knowledge of compound interest and more! ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon Rate = 100 / 500 * 100 = 20%. Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds. Bonds pay interest to their holders. The coupon rate is the amount of interest the bondholder receives.

What is the Coupon Rate? - Realonomics The coupon rate is the interest payments that are made to bondholders, annually or semi-annually, as compensation for loaning the issuer a given amount of money. 6 For example, a bond with par value of $1,000 and a coupon rate of 4% will have annual coupon payments of 4% x $1,000 = $40. Where is the coupon rate on a BA II Plus?

What Is the Coupon Rate of a Bond? - The Balance How Coupon Rates Work . A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

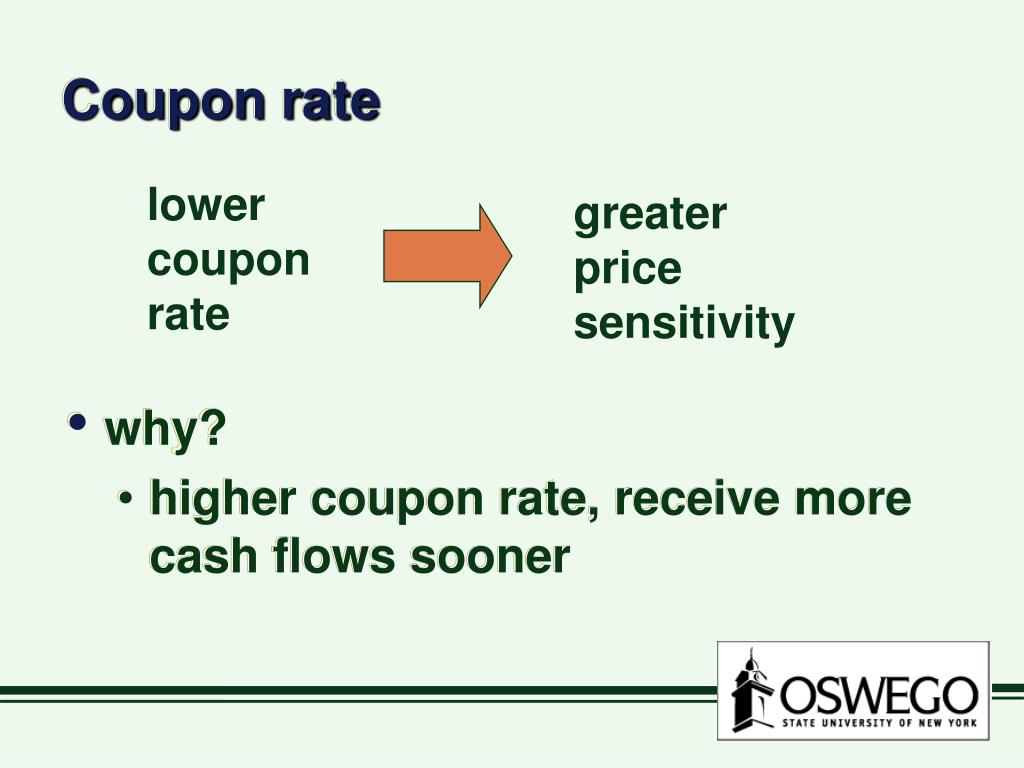

Understanding the Relationship Between Coupon Rates and Duration A high coupon rate bond provides more cash flow than a low coupon rate bond. Accordingly, a high coupon rate bond has a lower duration that a low coupon bond. For example, if I purchase a zero-coupon bond on its issue date the bond will have a duration of 30 years - no cash flow until the bond matures.

Coupon rate financial definition of Coupon rate - TheFreeDictionary.com Coupon rate. The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons.

What Is a Coupon Rate? And How Does It Affects the Price of a Bond ... The coupon rate is also called coupon payment. It is the yield the bond paid on its issue date. The yield changes when the value of the bond changes. Such a case results in giving the bond's yield to maturity. In the case of the booming market, the coupon holder yields lesser than the prevailing market conditions as bonds won't pay more.

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Coupon Rate Calculator | Bond Coupon What is a coupon? A coupon is the interest payment of a bond. Typically, it is distributed annually or semi-annually depending on the bond. We usually calculate it as the product of the coupon rate and the face value of the bond. How often do I receive coupons from investing in bonds? The short answer is it depends on the bonds that you invest in.

Post a Comment for "38 what are coupon rates"