42 ytm for zero coupon bond

YTM for a zero coupon bond? | Forum | Bionic Turtle so, yeild (YTM) = r = LN (F/P)*1/T; i.e., given the three unknowns, there is only one yield ...and similar logic for discrete frequencies ...Re: "zero coupon bond has just one payment," totally agree Return of zero coupon bond in Excel. YTM of zero coupon bond with Excel ... Learn how to calculate yield to maturity (YTM) of a zero coupon bond with excel. @RK varsity

Yield to Maturity (YTM) of a Zero Coupon Bond.pdf - Yield... View Yield to Maturity (YTM) of a Zero Coupon Bond.pdf from CPE 103 at Boston University. Yield to Maturity (YTM) of a Zero Coupon Bond 2 of

Ytm for zero coupon bond

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds [ edit ] For bonds with multiple coupons, it is not generally possible to solve for yield in terms of price algebraically. Zero Coupon Bond Yield Calculator - YTM of a discount bond - Vin A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond. Zero-Coupon Bonds and Taxes - Investopedia Long-term zero-coupon bond investors gain the difference between the price they pay for the bond and the amount they receive at the bond's maturity. This amount can be substantial because...

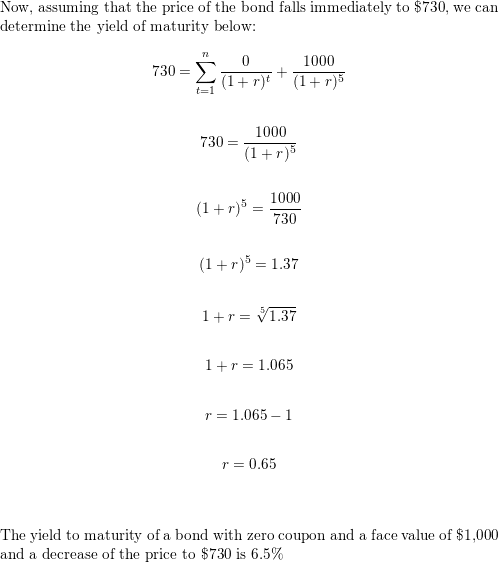

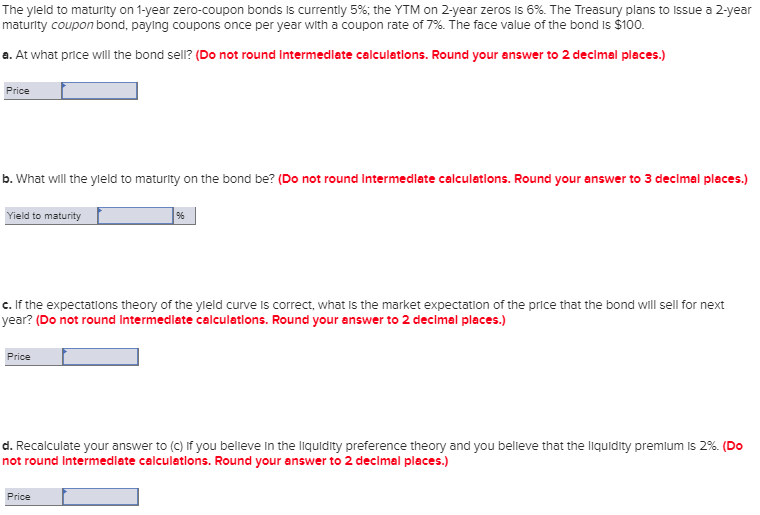

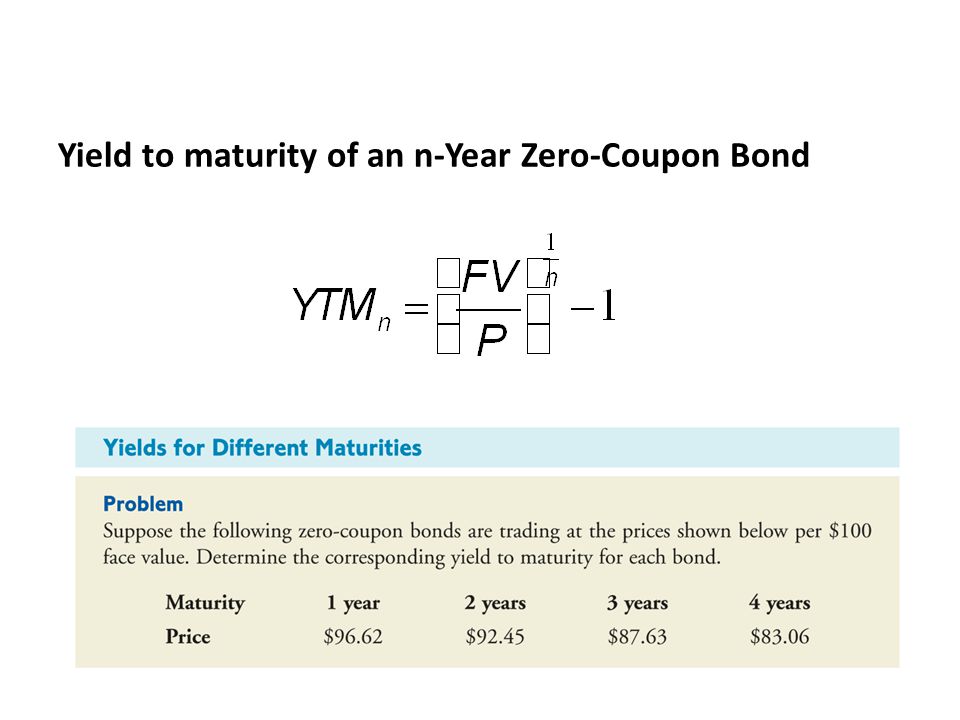

Ytm for zero coupon bond. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Solved What is the YTM for a zero coupon bond ($1,000 par) - Chegg Finance. Finance questions and answers. What is the YTM for a zero coupon bond ($1,000 par) maturing 18 months and 15 days from now selling for $900 today. Use semiannual rate approach. A. 7.19% B. 8.41% C. 6.94% D. 6.53% E. 7.81%. Question: What is the YTM for a zero coupon bond ($1,000 par) maturing 18 months and 15 days from now selling for ... › knowledge › zero-coupon-bondZero-Coupon Bond: Formula and Calculator [Excel Template] Zero-Coupon Bond Yield-to-Maturity (YTM) Formula The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula...

Yield to Maturity (YTM) - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Calculate the YTM of a Zero Coupon Bond - YouTube This video explains how to calculate the yield to maturity (YTM) of a zero coupon bond using the lump sum formula. CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL - YouTube In this lecture I am explaining how to #TYM#YieldToMaturity#HOW_TO_CALCULATE_YIELD_ON_ZERO_COUPON_BOND #YTM_IN_EXCEL calculate the yield on zero COUPON bond ... Zero-Coupon Bond Definition - Investopedia The interest earned on a zero-coupon bond is an imputed interest, meaning that it is an estimated interest rate for the bond and not an established interest rate. For example, a bond with a face...

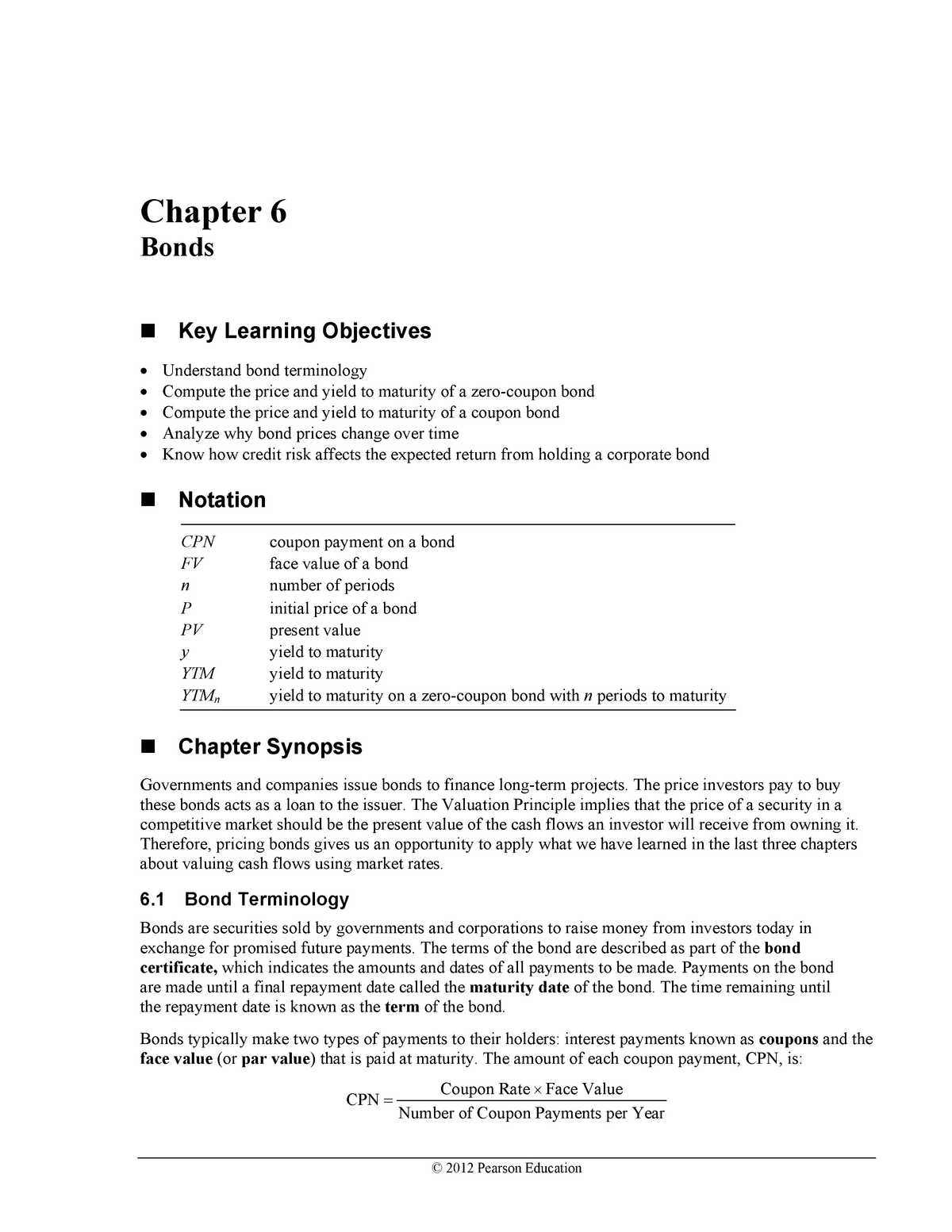

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: Calculating the Yield of a Zero Coupon Bond - YouTube This video demonstrates how to calculate the yield-to-maturity of a zero-coupon bond. It also provides a formula that can be used to calculate the YTM of an... dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: › yield-to-maturity-ytmYield to Maturity (YTM) - Wall Street Prep In comparison, the current yield on a bond is the annual coupon income divided by the current price of the bond security. An important distinction between a bond’s YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

How to Calculate The Yield To Maturity of A Zero Coupon Bond In this video I will explain what a zero coupon bond is and show you how to use the formula to calculate the yield to maturity of a zero coupon bond. This st...

› coupon-bond-formulaHow to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security).

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

What does it mean if a bond has a zero coupon rate? - Investopedia Ariel Courage. A bond's coupon rate is the percentage of its face value payable as interest each year. A bond with a coupon rate of zero, therefore, is one that pays no interest. However, this ...

Zero-Coupon Bonds and Taxes - Investopedia Long-term zero-coupon bond investors gain the difference between the price they pay for the bond and the amount they receive at the bond's maturity. This amount can be substantial because...

Zero Coupon Bond Yield Calculator - YTM of a discount bond - Vin A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond.

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds [ edit ] For bonds with multiple coupons, it is not generally possible to solve for yield in terms of price algebraically.

Post a Comment for "42 ytm for zero coupon bond"