38 coupon rate of bond

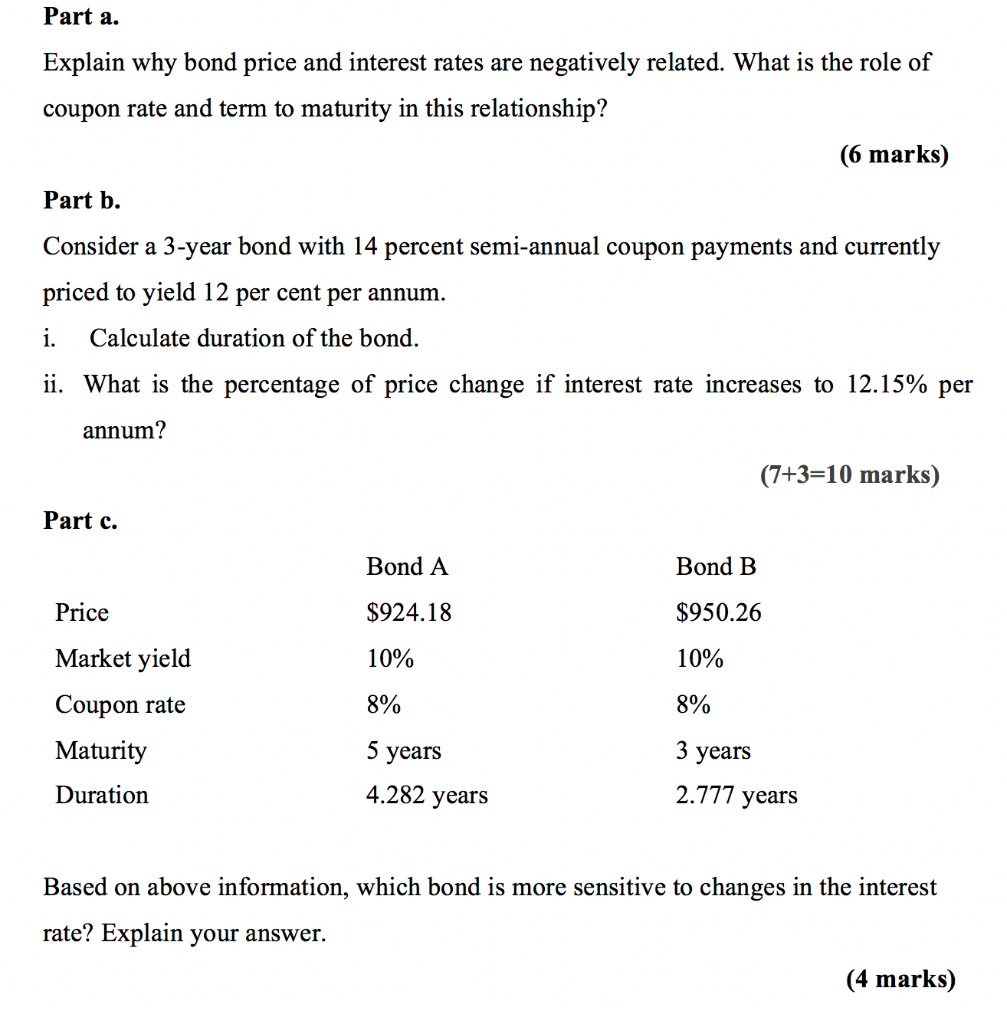

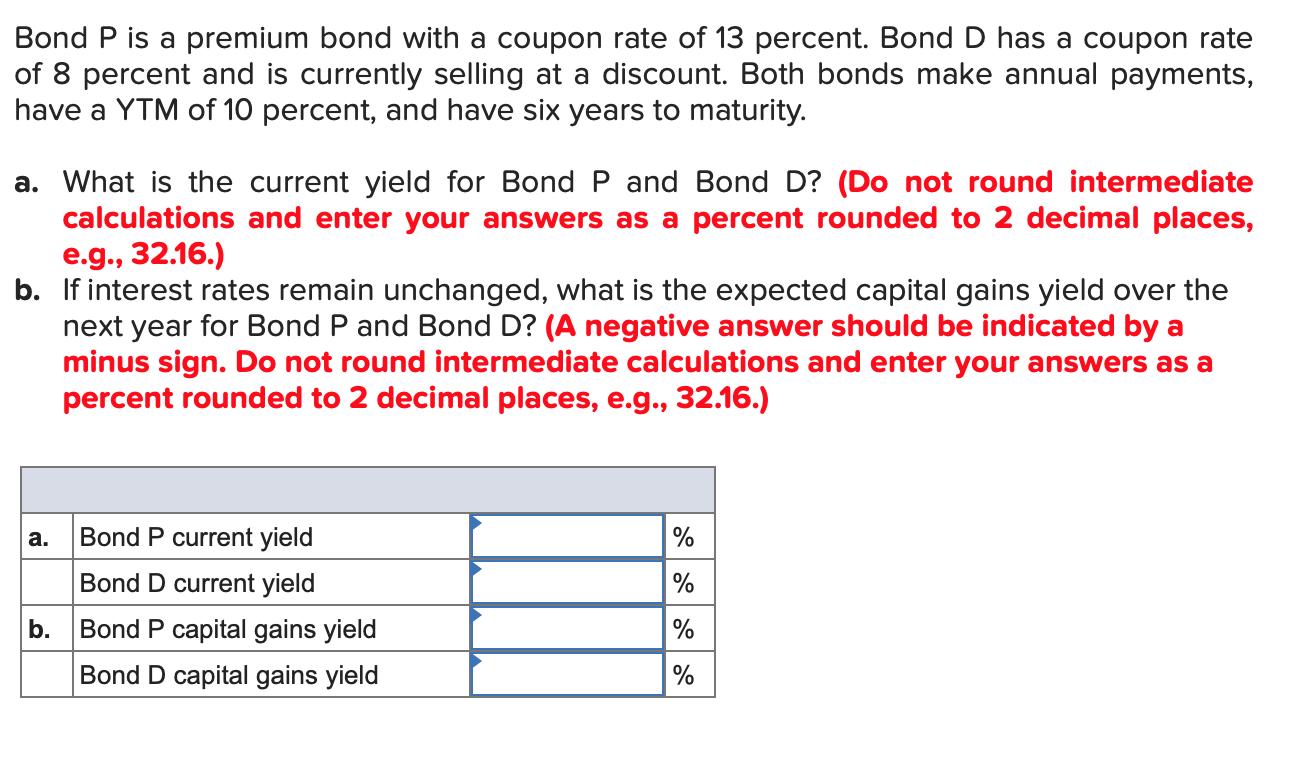

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ...

en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

Coupon rate of bond

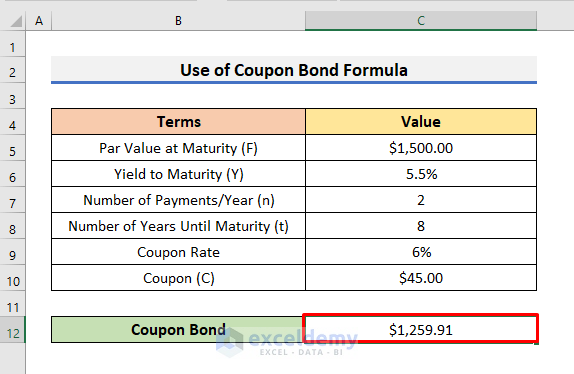

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... › what-is-the-coupon-rateWhat Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · Coupon Rate vs. Yield . In contrast to the bond’s coupon rate, which is a stated interest rate based on the bond’s par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond. en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ...

Coupon rate of bond. smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ... › what-is-the-coupon-rateWhat Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · Coupon Rate vs. Yield . In contrast to the bond’s coupon rate, which is a stated interest rate based on the bond’s par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond. › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Post a Comment for "38 coupon rate of bond"